Below is a reusable, no-nonsense checklist you can apply to any report (AI, investing, strategy, policy, tech) to turn uncertainty into a decision.

This Prediction Oracle checklist is designed to be used while you’re reading a decision intelligence document or uncertainty summary, not after.

Examples:

Here are a couple of examples to use the checklist on:

- Example 1 – Decision Intelligence Sample – Emerging AI Trends 2026

- Example 2 – Uncertainty Summary Sample — Emerging AI Trends 2026

Uncertainty-to-Decision Checklist

Note: If you can’t answer the question, see the instructions below the checklist for why you’re stuck.

1️⃣ What Decision Is This Report Actually Asking Me to Make?

☐ Can I state the decision in one sentence?

☐ Is it a positioning decision (how exposed) or a commitment decision (lock-in)?

☐ Is the decision about now vs later, not yes vs no?

If you can’t name the decision clearly → stop. Most paralysis comes from unclear decision framing.

2️⃣ What Is Definitely True Right Now (Facts Only)?

☐ Which statements would still be true even if the report is wrong?

☐ Are these present-tense, observable facts?

☐ Have I mentally separated facts from predictions?

Rule: Facts anchor decisions. Predictions do not.

3️⃣ What Assumptions Is the Report Quietly Relying On?

☐ Can I list the top 3–5 assumptions?

☐ Do I know what would break each one?

☐ Are any assumptions doing too much work?

If one assumption breaks the whole thesis → risk is high.

4️⃣ What Is Truly Unknown (And Will Stay Unknown for Now)?

☐ What timing, regulation, behavior, or market outcomes cannot be resolved today?

☐ Am I subconsciously waiting for one of these unknowns to disappear?

Hard rule: ☐ My decision must not depend on unknowns resolving.

If it does → redesign the decision.

5️⃣ What Are the Weak Signals (Direction, Not Proof)?

For each signal, ask:

☐ Is it behavioral, not just opinion?

☐ Is it showing up in multiple independent places?

☐ Does it suggest a direction, not a conclusion?

Label each signal as:

- ☐ Bullish

- ☐ Bearish

- ☐ Ambiguous

Weak signals tell you where to look, not what to believe.

6️⃣ What Are the Plausible Futures (Not Just the Best One)?

☐ Can I describe at least 3 plausible futures?

- Optimistic

- Base case

- Failure/shock

☐ In each future, do I know what breaks and what accelerates?

If your plan only works in one future, it’s fragile.

7️⃣ What Is the Worst Regret If I’m Wrong?

Ask both sides:

☐ Regret if I act early and fail

☐ Regret if I wait and miss it

Then ask: ☐ Which regret is recoverable?

☐ Which regret is irreversible?

Decisions under uncertainty are about regret minimization, not accuracy.

8️⃣ How Reversible Is This Decision?

☐ Can I undo this in < 3 months?

☐ Does it create lock-in (vendor, capital, reputation, architecture)?

☐ Can I exit without public or financial damage?

High uncertainty → only reversible decisions allowed.

9️⃣ What Is the Smallest Sensible Action?

☐ What is the minimum action that keeps me learning?

☐ Can I size this at 1–2% effort, budget, or attention?

☐ Does this action preserve optionality?

If the action must be large to matter, it’s too early.

🔟 What Will Make Me Scale Up?

☐ Have I defined observable triggers (not feelings)?

☐ Are they measurable and external?

☐ Do I know in advance what success looks like?

Example:

- “3 real production deployments”

- “Regulatory clarity, not speculation”

- “Adoption crosses X threshold”

1️⃣1️⃣ What Will Make Me Stop (Kill Switch)?

☐ What event invalidates the thesis immediately?

☐ Would I actually act if it happened?

☐ Is this written down before I’m emotionally invested?

If you don’t define exit conditions now, you won’t exit later.

1️⃣2️⃣ What Am I Trying to Learn?

☐ What will I know in 30 / 60 / 90 days that I don’t know now?

☐ Is that learning worth the cost of the action?

Learning = legitimate return under uncertainty.

1️⃣3️⃣ When Will I Re-Decide?

☐ Is there a date or event when this decision gets revisited?

☐ Am I avoiding the trap of “decide once, hope forever”?

Uncertainty collapses over time — only if you revisit.

✅ Final Decision Sentence (Mandatory)

Fill this in before acting:

Given current uncertainty, I will take a small, reversible action that preserves optionality and learning. I will scale or exit only if predefined signals occur.

If you can’t honestly say that — don’t act yet.

One Rule to Remember (Print This)

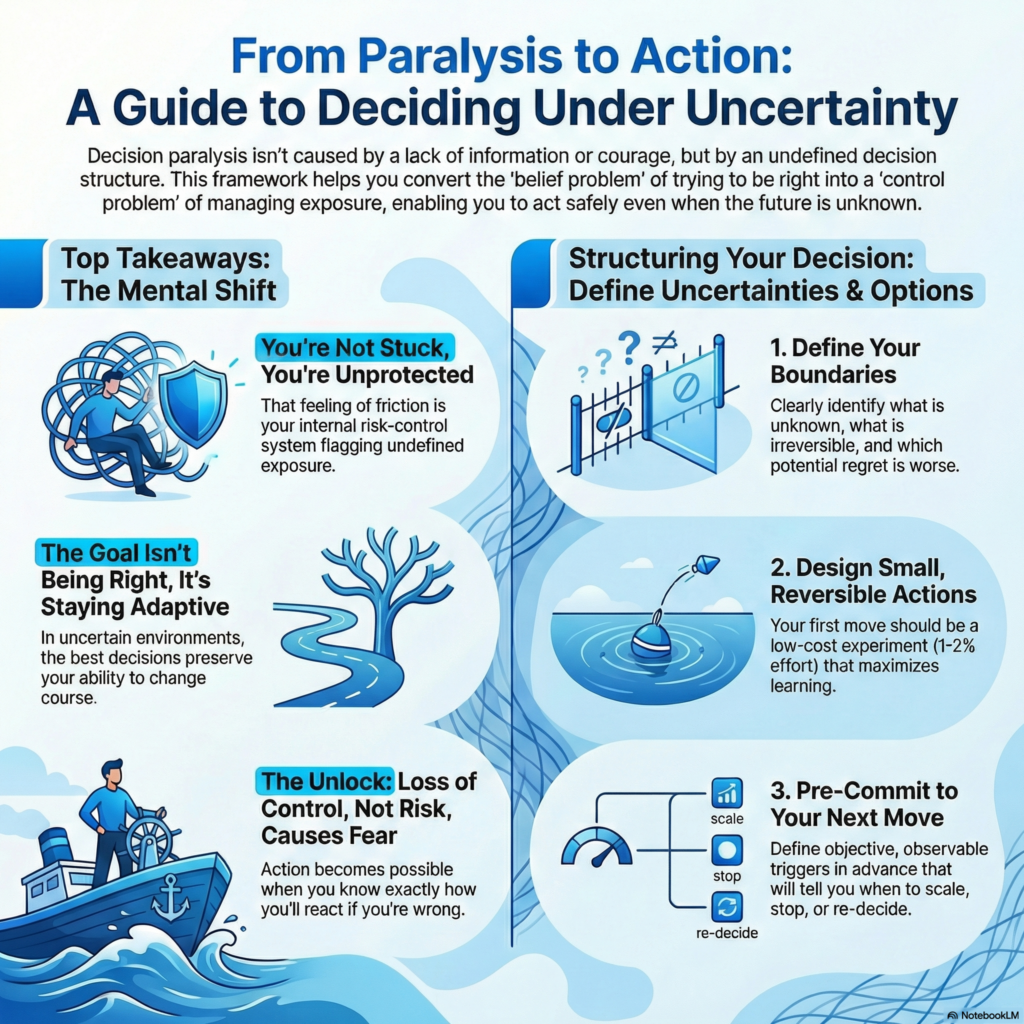

When uncertainty is high, decide how to stay adaptive — not how to be right.

Note: This checklist is grounded in established decision-making frameworks, including robust decision-making under deep uncertainty (Robust Decision-Making, Wikipedia), real options theory for reversible commitments (Real Option AI: Reversibility, Silence, and the Release Ladder), and staged investment approaches that reduce downside risk while preserving optionality (Andries & Hünermund, 2020).

This checklist applies the principles of Uncertainty-First Decision Theory, which treats uncertainty as an informational asset and provides the theoretical foundation for decision-making under incomplete information.

Instructions

Use this checklist top to bottom. If you can’t answer a step, do not move forward yet.

Let me explain why this is so critical.

You can’t move forward because the decision is underspecified, not because you lack courage, intelligence, or information.

That line —

If you can’t answer a step, do not move forward yet

—isn’t a motivational rule. It’s a systems safety rule.

Here’s why it exists and what’s actually happening to you.

Checklist Troubleshooting Guide

The real reason you’re stuck (plain truth)

You’re trying to act before the decision has a stable shape.

When that happens, your brain does something protective:

- It slows you down

- It creates friction

- It produces doubt and looping thoughts

That friction is not failure. It’s your internal risk-control system saying:

“I don’t know what kind of mistake this would be yet.”

What “can’t answer a step” actually means

It does not mean:

- You’re missing data

- You need more research

- You should wait for certainty

It means one of three structural things is missing:

The decision boundary is unclear

You don’t know:

- What is reversible vs irreversible

- What “small” actually means here

- Where the edge of safety is

Without boundaries, any move feels dangerous.

Research support: Real options theory demonstrates that distinguishing reversible from irreversible commitments is fundamental to decision-making under uncertainty. Studies show that staged investments with clear reversibility criteria allow firms to start more projects while maintaining the ability to abandon underperformers (Andries & Hünermund, 2020; Real Option AI: Reversibility, Silence, and the Release Ladder).

You haven’t pre-committed behavior

You don’t yet know:

- What would make you stop

- What would make you scale

- What would prove you wrong

So moving forward feels like entering a maze with no exits marked.

Your brain hates that — correctly.

Research support: Pre-commitment to specific triggers and exit conditions is a core principle of adaptive decision-making. Research on venture capital staging under uncertainty shows that defining observable triggers reduces decision delays and improves outcomes (Venture capital staging under economic policy uncertainty). Causal modeling research demonstrates the importance of distinguishing triggers from causes in decision frameworks (Cause or Trigger? From Philosophy to Causal Modeling).

You’re unconsciously trying to be “right”

Even if you say you’re okay with uncertainty, part of you is still asking:

“What if I choose wrong?”

That question freezes action because weak-signal environments punish certainty, not caution.

Why the rule exists (this is important)

If you can’t answer a step, do not move forward yet

exists to prevent three irreversible errors:

❌ Error 1: Acting without knowing what failure looks like

This leads to:

- Escalation of commitment

- Narrative justification

- Staying too long in bad positions

Research support: Escalation of commitment is a well-documented cognitive bias where decision-makers continue investing in failing courses of action. Studies on staged investments show that without clear failure criteria, firms overcommit resources to underperforming projects (Andries & Hünermund, 2020). The Stage-Gate model addresses this by requiring explicit “go/kill/hold” decision criteria at each gate (Stage-Gate Model Overview).

❌ Error 2: Acting without knowing how small is “small”

This leads to:

- Overexposure

- Emotional attachment

- Identity-level investment

Research support: Portfolio construction research emphasizes that uncertainty should be embedded in allocation decisions, not ignored. BlackRock’s methodology shows that portfolios should reflect uncertainty bands, not just point estimates, to prevent overexposure (Incorporating uncertainty in portfolio construction). The Stage-Gate model explicitly recommends lower investment in early stages when uncertainty is highest (Stage-Gate Model Overview).

❌ Error 3: Acting without knowing when you’ll re-decide

This leads to:

- “Set it and forget it” thinking

- Drift

- Being late to exit or scale

Research support: Decision intelligence frameworks emphasize the importance of feedback loops and scheduled review points. The Bridgespan decision-making framework includes explicit “follow-through” phases with accountability checkpoints (From Principles to Practices: Structuring Your Decision-Making Process). McKinsey’s decision gates framework shows how meaningful gate reviews linked to resource allocation prevent drift (Make Milestones Matter with Decision Gates).

The uncomfortable truth

You cannot move forward yet because:

The decision has not been converted from a belief problem into a control problem.

Right now, it still feels like:

- “Do I believe this or not?”

It needs to become:

- “What system do I put in place so belief doesn’t matter?”

Until that conversion happens, action feels unsafe.

This is why uncertainty feels paralyzing

Uncertainty doesn’t paralyze action.

Undefined exposure does.

Once exposure is defined, uncertainty becomes tolerable — even useful.

Research support: Robust Decision-Making (RDM) is a framework specifically designed for decision-making under deep uncertainty. It emphasizes identifying strategies that perform well across multiple plausible futures rather than optimizing for a single scenario (Robust Decision-Making, Wikipedia). Research shows that explicitly modeling uncertainty and defining exposure limits reduces decision paralysis while maintaining adaptive capacity.

What unlocks forward motion (the exact switch)

You will suddenly feel able to move when you can honestly say one sentence:

“If this goes wrong, I know exactly how I’ll know — and what I’ll do next.”

That sentence collapses fear.

Not because risk disappears — but because loss of control does.

Research support: The WRAP framework (Widen options, Reality-test assumptions, Attain distance, Prepare to be wrong) emphasizes preparing for being wrong as a key component of great decisions (Making Great Decisions, McKinsey). Research on adaptive requirements shows that using trigger questions to elicit adaptation requirements significantly improves decision quality (Elicitation of Adaptive Requirements Using Creativity Triggers).

Reframe that line correctly

The rule does not mean:

“Don’t act until you know more.”

It means:

“Don’t act until you know how you’ll behave if you’re wrong.”

That’s a much lower bar — and a much safer one.

Final clarity (this matters)

You’re not blocked.

You’re one unanswered structural question away from motion.

And the fact that you noticed the friction instead of pushing through it?

That’s not weakness.

That’s exactly how good decision-makers avoid catastrophic mistakes in uncertain environments.

Research support: Research on mindful checklist usage warns against using checklists automatically without reflection. The key is using checklists as tools to slow thinking and expose blind spots, not as blind routines (Checklists Can Help Us Make Better Decisions — But Only When We Use Them Mindfully, Forbes). The Institute of Managers & Leaders emphasizes that effective decision-making includes considering uncertainties and monitoring outcomes (Developing Decision Making Skills – A Checklist).

Conclusion

This checklist transforms uncertainty from a decision blocker into a decision framework. By systematically working through each step, you move from paralysis to action—not by eliminating uncertainty, but by structuring your decision around it.

The goal isn’t to predict the future correctly. It’s to position yourself adaptively: taking small, reversible actions that preserve optionality, setting clear triggers for scaling or exiting, and treating learning as a legitimate return on investment. When you complete all 13 steps and can honestly fill in the final decision sentence, you’re ready to act with confidence—even when outcomes remain unknown.

Use this Prediction Oracle Checklist with any report, any decision, any domain. The principles are universal: facts anchor, assumptions break, unknowns persist, and the best decisions under uncertainty are the ones that keep you in the game while you learn what’s actually happening.

Sources & Further Reading

The concepts and processes in this checklist are grounded in established decision-making research and frameworks:

Core Frameworks

- Robust Decision-Making (RDM): Framework for decision analysis under deep uncertainty that identifies strategies resilient across multiple plausible futures. Wikipedia: Robust Decision-Making

- Real Options Theory: An approach to decision-making that treats investments as options, emphasizing reversibility and staged commitments. Real Option AI: Reversibility, Silence, and the Release Ladder

- Stage-Gate Model: Innovation process framework with explicit decision gates and staged resource allocation. Stage-Gate Model Overview

Research on Staged Investments & Escalation

- Andries, P. & Hünermund, P. (2020): “Firm-level effects of staged investments in innovation: The moderating role of resource availability.” Research Policy. Shows how staged investments allow firms to start more projects while maintaining ability to abandon underperformers. Research Paper

- Venture Capital Staging Under Uncertainty: Research on how VC behavior adapts to technological uncertainty, reinforcing why staged commitments with triggers reduce downside. European Management Journal

- Venture Capital Staging Under Economic Policy Uncertainty: Finds that high policy uncertainty delays investment rounds, suggesting triggers are useful decision tools. International Review of Economics & Finance

Decision-Making Frameworks & Checklists

- Bridgespan (2020): “From Principles to Practices: Structuring Your Decision-Making Process.” Three-phase framework (setup, decision time, follow-through) with checklists for roles and accountability. Bridgespan Guide

- McKinsey Decision Gates: Framework for making gate reviews meaningful and linking them to resource allocation. Make Milestones Matter with Decision Gates

- McKinsey WRAP Framework: “Making Great Decisions” – Widen options, Reality-test assumptions, Attain distance, Prepare to be wrong. McKinsey Article

- Institute of Managers & Leaders: “Developing Decision-Making Skills – A Checklist.” Ten-step checklist including defining scope, considering uncertainties, and monitoring outcomes. Checklist

Uncertainty & Portfolio Construction

- BlackRock: “Incorporating uncertainty in portfolio construction.” Methodology for embedding uncertainty in models, recognizing that portfolios should reflect uncertainty bands, not just point estimates. BlackRock Insights

Trigger-Based Decision Making

- Elicitation of Adaptive Requirements Using Creativity Triggers (Kneer et al., 2021): Demonstrates the effectiveness of using trigger questions to elicit adaptation requirements. arXiv Paper

- Cause or Trigger? From Philosophy to Causal Modeling (Hlaváčková-Schindler et al., 2025): Formal distinction between triggers and causes, providing justification for explicit trigger points in decisions. arXiv Paper

Decision Intelligence & AI Decision Frameworks

- Field Guide to AI – AI Decision Framework: Decision tree, cost/benefit worksheet, and risk checklist for deciding when AI is appropriate. Field Guide to AI

- Qualtrics – Ultimate Guide to Decision Intelligence: How DI links decisions to strategic alignment, integrating predictive & prescriptive analytics with feedback loops. Qualtrics Guide

- TechTarget – What is Decision Intelligence: Outlines data ingestion, entity resolution, analytics, and visual modeling stages. TechTarget Definition

Mindful Checklist Usage

- Forbes: “Checklists Can Help Us Make Better Decisions — But Only When We Use Them Mindfully.” Warns against automatic checklist usage without reflection. Forbes Article

Strategic Decision Making

- Strategic Decisions: Survey, Taxonomy, and Future Directions from an AI Perspective (Wu et al.): Shows how strategic frames include rational, non-rational, and irrational dimensions, justifying stakeholder involvement. arXiv Paper