Uncertainty Deep Dive

The following sample audio is an example of a Prediction Oracle – Uncertainty Summary.

The complete report package includes 5 reports, along with the accompanying research, analysis, and source artifacts.

Listen to the Uncertainty Summary

About this audio:

This AI-generated Deep Dive discusses the Prediction Oracle’s AI Uncertainty Summary referenced in the focus study about Emerging AI Trends in 2026.

Prediction Oracle Tools

Before we get started, here are a couple of tools designed to help with tough, complex decision-making.

- Tool 1 is a step-by-step guide: How to Use Decision Intelligence and Uncertainty to Decide What to Do

- Tool 2 is n easy to use checklist: Uncertainty-to-Decision Checklist

Decision Context & Strategic Positioning

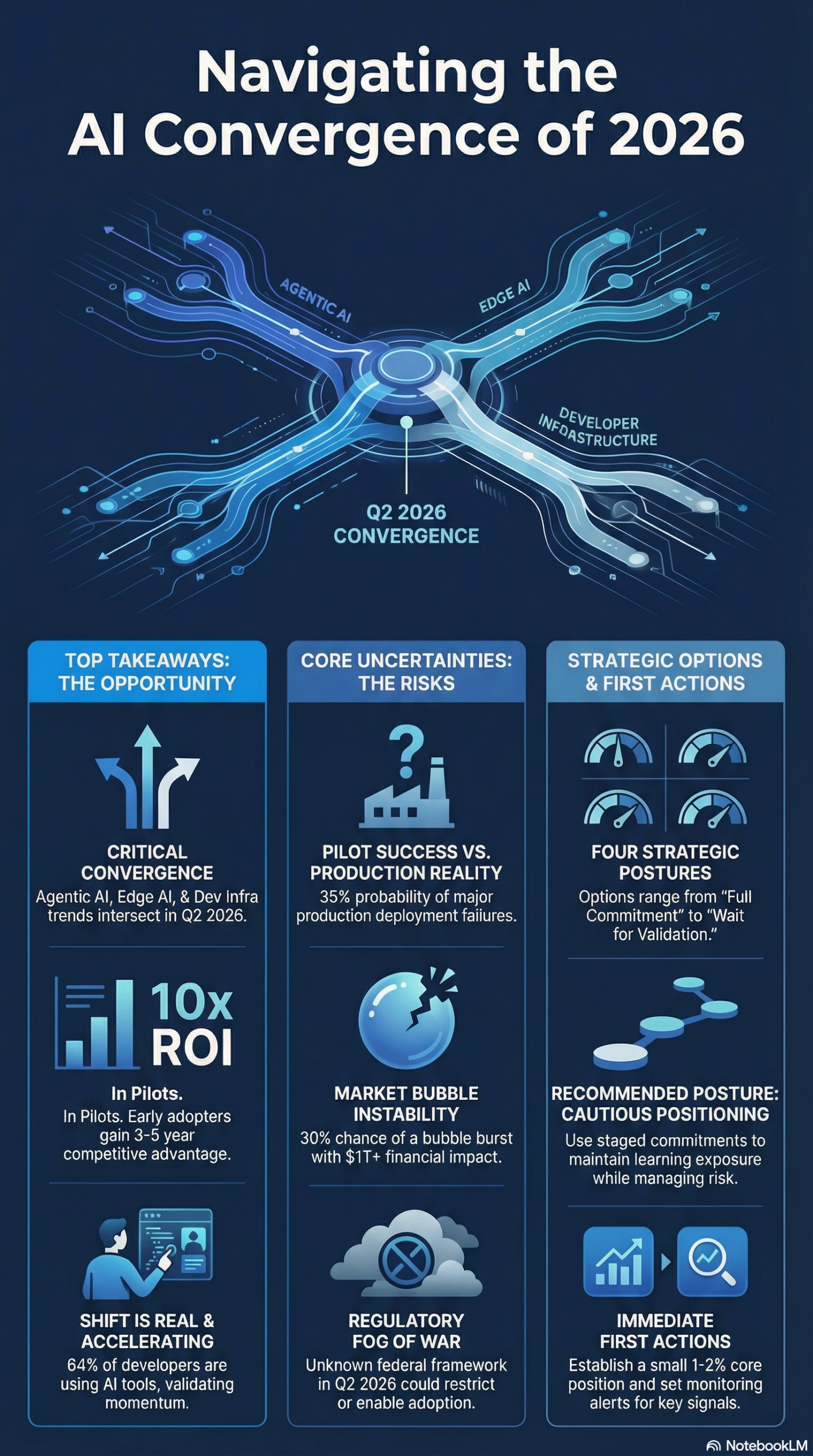

Focus Area: How organizations should position themselves for the convergence of three AI trends (Agentic AI, Edge AI, Developer Infrastructure Shift) by Q2 2026.

Uncertainties:

- Timing Uncertainty: Will Q2 2026 convergence occur as predicted, or shift to Q1/Q3? (Target exists, but multiple dependencies create uncertainty)

- Production Deployment Timeline: Will production deployments scale within 6-12 months of pilots, or will delays occur? (Pilot success doesn’t guarantee production timeline)

- Market Bubble Timing: If bubble bursts, when will it occur? (30% probability, but timing uncertain—Q2-Q4 2026 range)

Options:

- Full Commitment Now: 3-5x returns if convergence succeeds, but 40-70% capital loss if production failures/bubble burst occur

- Staged Entry: Meaningful upside participation, can scale as signals confirm, balanced risk/reward

- Wait for Validation: Lower risk but lower returns, may miss Q2 2026 convergence window

- Hedged Position: Upside participation with tail risk protection, balanced risk/reward

Early Signals & Monitoring Framework

Focus Area: The 8 early signals that indicate direction (not proof) of how trends are developing.

Key Signals to Discuss:

- Convergence Acceleration Pattern (Bullish): Three trends showing strong correlation (r = 0.65-0.85) converging toward Q2 2026

- Production Deployment Divergence (Ambiguous): 10x ROI in pilots vs. 35% probability of major production failures

- Regulatory Framework Timing Gap (Ambiguous): 18+ state laws effective Jan 1, 2026, but federal framework expected Q2 2026—4-6 month gap

- Market Bubble Warnings Persistence (Bearish): Multiple warnings (30% probability) but investment flows remain strong

- Standardization Momentum vs. Fragmentation Risk (Ambiguous): Linux Foundation coordination vs. 28% probability of failure

- DeepSeek Validation Uncertainty (Ambiguous): 75.3% validation probability but 45% failure risk, 33% export control risk

- Infrastructure Dependency Risk (Bearish): Edge AI depends on 5G/edge computing, 30% probability of 18-month delays

- Developer Adoption Acceleration (Bullish): Stack Overflow questions declined 76%, 84% developers using/planning AI tools

Uncertainties:

- Signal Interpretation: Which signals are noise vs. meaningful indicators?

- Signal Timing: When will signals resolve into clear trends?

- Signal Convergence: Will multiple signals align or diverge?

Options:

- Daily Monitoring: For critical scenarios (Bubble Burst, Export Control, Production Failures)

- Weekly Monitoring: For medium-priority scenarios (Standardization, Infrastructure, DeepSeek)

- Monthly Review: Comprehensive review of all signals, assumptions, and unknowns

- Event-Driven Review: Immediate re-evaluation upon trigger events

Plausible Futures & Scenario Planning

Focus Area: The 7 plausible futures that could unfold, each with different implications.

Futures to Discuss:

- “Convergence Success” (Optimistic): Trends converge Q2 2026, early adopters gain 3-5 year competitive advantage

- “Production Failure Pullback” (Pessimistic): 35% probability, 45% deployment pullback, 12-18 month delays

- “Market Bubble Burst” (Disruptive/Negative): 30% probability, $1T+ financial impact, 65% adoption slowdown

- “Regulatory Restriction” (Disruptive/Negative): 20% probability, could block adoption entirely, $250B+ market impact

- “Standardization Fragmentation” (Delayed): 28% probability, 12-24 month delays, 30-60% cost increases

- “Infrastructure Delay” (Delayed): 30% probability, Edge AI timeline shifts 12-18 months

- “DeepSeek Export Control” (Disruptive/Negative): 33% probability, blocks adoption, $100B market impact

Uncertainties:

- Which Future Will Materialize: Multiple futures are plausible, each with different probabilities

- Timing of Future Realization: When will we know which future is unfolding?

- Cascade Effects: How will one future trigger others?

Options:

- Scenario-Based Planning: Prepare strategies for each plausible future

- Flexible Architecture: Design systems that can adapt to multiple futures

- Early Warning Systems: Monitor for indicators of which future is emerging

- Portfolio Approach: Diversify across strategies to hedge against different futures

Decision Options & Regret-Based Analysis

Focus Area: The 4 decision options evaluated through regret-based analysis (upside if right, downside if wrong).

Options to Deep Dive:

- Full Commitment Now: 3-5x returns if right, 40-70% loss if wrong, partially reversible

- Staged Entry: Meaningful participation, can scale, highly reversible, preserves maximum optionality

- Wait for Validation: Lower risk/reward, fully reversible, may miss convergence window

- Hedged Position: Upside participation with protection, flexible risk management, maximum optionality with risk management

Uncertainties:

- Which Option Is Optimal: Depends on risk tolerance and uncertainty resolution

- Reversibility Costs: How expensive will it be to change course?

- Opportunity Cost: What is the cost of waiting vs. acting now?

Options:

- Recommended: Staged Entry with 1-2% Initial Investment: Balances optionality and learning with limited downside

- Scale-Up Triggers: 3+ bullish triggers within 30 days → increase to 2-4%

- Scale-Down Triggers: 2+ bearish triggers within 30 days → reduce by 50%+

- Exit Conditions: 4+ bearish triggers or any kill switch condition → exit immediately

Update Triggers & Re-Evaluation Framework

Focus Area: The specific observable conditions that would justify changing the recommended strategy.

Bullish Triggers (Scale Up):

- Q2 2026 convergence occurs on schedule

- Production deployments succeed (3+ Fortune 500 companies, <20% failure rate)

- Regulatory framework provides clarity

- Standardization achieves 50%+ adoption

- Infrastructure readiness improves

- DeepSeek method validates with no export controls

Bearish Triggers (Scale Down/Exit):

- Production failures occur (3+ major failures, >30% failure rate)

- Regulatory restrictions introduced

- Market bubble bursts (6+ indicators trigger)

- Standardization fragments (<20% adoption after 6 months)

- Infrastructure delays persist (>6 months)

- DeepSeek export controls expand

Uncertainties:

- Trigger Timing: When will triggers occur?

- Trigger Reliability: How reliable are these triggers as indicators?

- False Positives: How to avoid reacting to false signals?

Options:

- Pre-Committed Triggers: Define triggers in advance to avoid emotional decisions

- Multi-Signal Validation: Require multiple signals before acting

- Cooldown Periods: Wait periods before acting on triggers

- Confidence Thresholds: Only act when confidence exceeds threshold

Executive Summary & Key Takeaways

Focus Area: The core message that waiting for certainty is the biggest risk.

Key Message: “The risk is not being wrong—it’s being too late.” If Q2 2026 convergence occurs on schedule, early adopters gain 3-5 year competitive advantages. By the time production deployments are proven and regulatory clarity exists, the best entry point will have passed.

Uncertainties:

- Certainty Timeline: When will uncertainties resolve?

- Premium Cost: What premium will be paid for waiting?

- Competitive Positioning: How will waiting affect competitive position?

Options:

- Start Small (1-2% Core Position): Maintains optionality, limits downside, enables learning

- Monitor Actively: Set alerts for key indicators

- Prepare Scaling Plan: Define specific triggers for increasing/decreasing position

- Reserve Capital: 5-10% for staged commitments as signals evolve

Infographic:

Sources:

This audio was generated with NotebookLM on 01-10-2026 using the Prediction Oracle Trend Report referenced in the Sample Report: Emerging AI Trends 2026 Strategic Options

- Decision Intelligence Document:

decision-intelligence-emerging-ai-trends-2026-2026-01-16-v2.md– Watch the Decision Intelligence Deep Dive: Decision Intelligence Sample – Emerging AI Trends 2026 - Trender Report:

Emerging-AI-Trends-2026-trender-report-2026-01-04-v1.md(6 trends, 82% confidence). Listen to an audio Deep Dive: Sample Report – Emerging AI Trends for 2026 (audio version) - Predictions Report:

emerging-ai-trends-2026-predictions-report-2026-01-04-v1.md(7 predictions, 87% confidence) Listen to an audio Deep Dive: Sample Report – Emerging AI Predictions for 2026 (audio version) - Black Swan Assessment:

emerging-ai-trends-2026-black-swan-assessment-2026-01-04-v1.md(8 scenarios, 78% confidence) Listen to the deep dive: Sample Report – Emerging AI Trends 2026 Black Swan Assessment (audio version) - Uncertainty Summary: uncertainty-summary

-ai-trends-2026-black-2026-01-16-v1.md(8 scenarios, 78% confidence) Listen to the deep dive: Uncertainty Summary Sample – Emerging AI Trends 2026 (audio version)

If you’d like to see more sample reports like this, visit the Prediction Oracle archive.

To improve our output, we welcome your professional, objective feedback and comments.