Use this how-to guide as a decision-making tool, not as a basis for belief or disbelief.

Here’s how to use uncertainty step-by-step to choose what to do, using the Decision Intelligence Sample from the AI Trends in 2026 post.

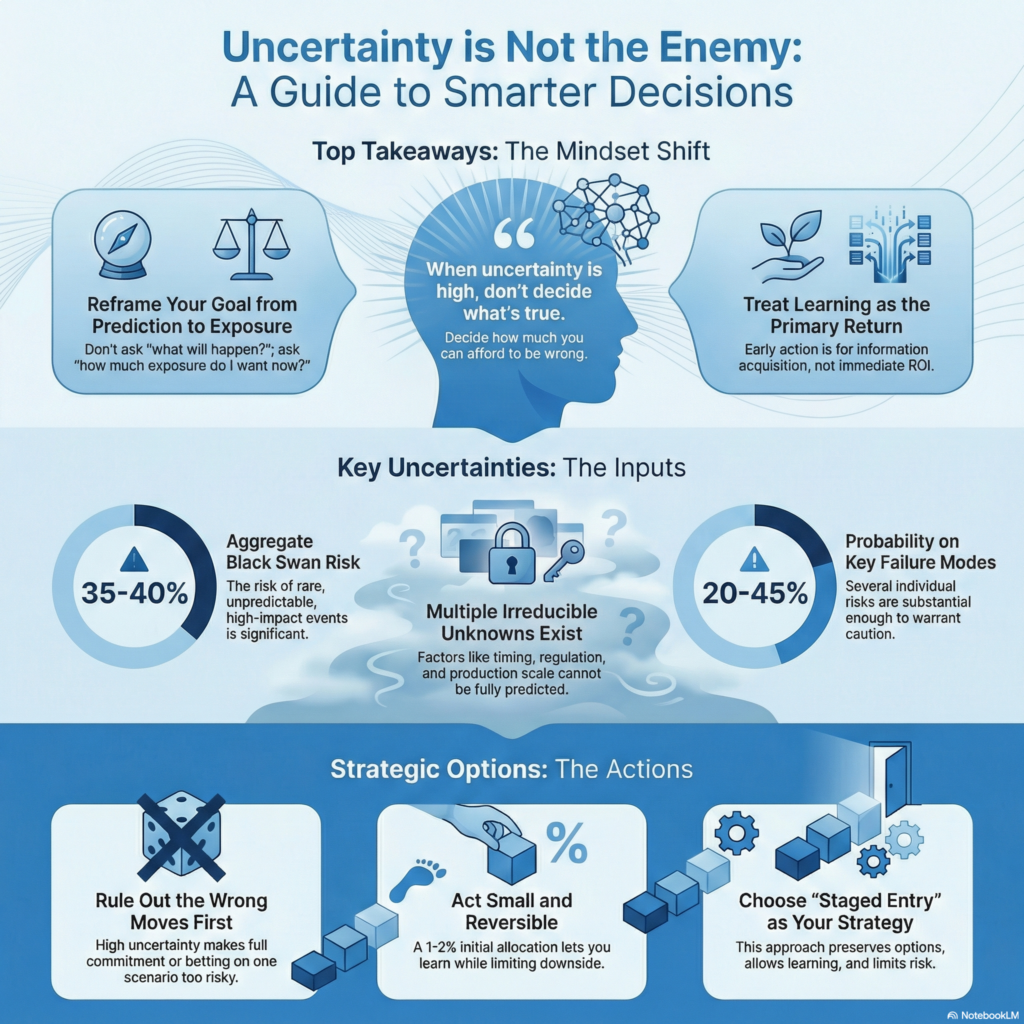

First: Reframe What a “Decision” Is

The report is not asking you to decide what will happen.

It is asking you to decide:

How much exposure you want while the outcome is still unknown.

That distinction is everything.

If you wait for uncertainty to disappear, the report itself tells you that:

- The convergence window will have passed

- Optionality will be gone

- You will be paying a premium for certainty

So uncertainty is not a blocker — it is the input.

New to decision intelligence?

If you’re just getting started, it might help to see the big picture first. Decision Intelligence, Explained walks through the core ideas — spotting weak signals, being honest about uncertainty, and using multiple ways of reasoning.

Step 1: Use Uncertainty to Rule Out the Wrong Moves

From the report’s own data:

- Aggregate Black Swan risk: 35–40%

- Multiple irreducible unknowns: timing, regulation, production scale, infrastructure

- Several failure modes with 20–45% probability each

This immediately tells you what not to do:

❌ Do not fully commit

❌ Do not lock into a single vendor or architecture

❌ Do not bet on one future scenario

Uncertainty narrows the option set before it selects one.

Step 2: Translate Uncertainty Into Position Size (Not Conviction)

The report does this explicitly for you:

- High directional confidence (98% predictions)

- High structural uncertainty (production, regulation, infrastructure)

- Resulting recommendation: 1–2% initial allocation

This is the key move:

Uncertainty doesn’t tell you “don’t act.” It tells you “act small and reversible.”

So the decision is not whether to engage — it is how lightly to engage.

Step 3: Let Uncertainty Choose the Decision Shape

Look at the four decision options in the report:

- Full commitment

- Staged entry

- Waiting

- Hedged position

Uncertainty eliminates three of them automatically:

- Full commitment fails the downside test

- Waiting fails the timing test

- Hedging is optional, but complex

What survives uncertainty is staged entry — because it:

- Preserves optionality

- Limits downside

- Allows learning

- Keeps you inside the convergence window

This is why the report selects staged entry without needing certainty.

Step 4: Convert Uncertainty Into Rules (This Is the Core Move)

Uncertainty becomes useful when it is turned into pre-committed triggers.

The report does not say:

- “Scale up when it feels right”

- “Exit if confidence drops”

It says:

- If 3+ Fortune 500 production successes → scale

- If 2+ bearish triggers in 30 days → cut

- If any kill switch fires → exit immediately

This is critical:

You are not deciding later under emotion. You are deciding now under clarity.

Uncertainty forces discipline.

Step 5: Treat Learning as the Primary Return

Because uncertainty is high, the report explicitly reframes success:

- Early action is not about ROI

- It is about information acquisition

- Learning is a valid return

So the question becomes:

“What will I know in 90 days that I don’t know now — and is that worth 1–2%?”

If the answer is yes, the action is justified even if the thesis fails.

Step 6: Use Uncertainty to Decide When, Not If

The report defines review moments:

- Q2 2026 convergence window

- Regulatory publication

- Production validation milestones

You are not deciding forever.

You are deciding:

- What to do until the next uncertainty collapses

This turns uncertainty into a timeline, not paralysis.

The Practical Decision (Plain Language)

If you are reading this report today, the decision is:

“I will take a small, reversible position that keeps me inside the game, learn from real signals, and only commit further if uncertainty resolves in my favor.”

That is exactly what the report recommends — and why.

One-Sentence Rule You Can Reuse

When uncertainty is high, don’t decide what’s true — decide how much you can afford to be wrong.

That is how this report is meant to be used.

Conclusion

Navigating uncertainty is a critical skill in decision-making, especially in the rapidly evolving domain of AI.

This how-to guide emphasizes the importance of using uncertainty as a constructive force in shaping decisions rather than a barrier.

By understanding how to manage exposure, maintain flexibility, and focus on learning, decision-makers can position themselves for success in an uncertain environment.

The guide transforms uncertainty in the Decision Intelligence Sample from a paralyzing force into a strategic tool. It teaches us that waiting for certainty is often the riskiest move of all, as it eliminates optionality and forces us to pay a premium for information that others have already acted upon.

Instead, by taking small, reversible positions, setting clear triggers, and treating learning as a primary return, we can navigate complex decisions with confidence even when outcomes remain unknown.

Ultimately, embracing uncertainty empowers organizations to act strategically even amidst ambiguity.

Using Decision Intelligence is not about eliminating uncertainty, but about structuring your decisions around it—using it to rule out wrong moves, size positions appropriately, choose the right decision shape, and create disciplined rules that prevent emotional decision-making later.

Want an easy-to-follow guide? Check out our Uncertainty-to-Decision Checklist.

FAQ

1. What is a Decision Intelligence Document?

A Decision Intelligence Document integrates various uncertainties into a structured framework to guide decision-makers in navigating complex choices. It doesn’t predict the future—instead, it helps you decide how much exposure you want while outcomes remain unknown.

2. How should I interpret uncertainties in the report?

Uncertainties should be seen as inputs for action, guiding how much exposure you’re willing to take, rather than as barriers to decision-making. High uncertainty doesn’t mean “don’t act”—it means “act small and reversible.”

3. What is staged entry, and why is it recommended?

Staged entry is a strategic approach where decisions are made gradually and reversibly, allowing organizations to adjust as more information becomes available. It’s recommended because it preserves optionality, limits downside risk, allows learning, and keeps you within the convergence window without requiring certainty.

4. Why is it important to frame success as information acquisition?

Viewing early actions as opportunities for learning enables organizations to adapt to real-time data, which is crucial when facing high uncertainty. Learning becomes a valid return on investment, making small positions justified even if the initial thesis fails.

5. What are Black Swan events, and how do they affect decision-making?

Black Swan events are rare and unpredictable occurrences that can have severe consequences on predictions and forecasts. The report identifies aggregate Black Swan risk at 35–40%, which immediately rules out strategies like full commitment or betting on a single future scenario.

6. How can I apply this framework to my organization?

Use the principles outlined in the report to guide your strategy assessment: start with small, reversible positions (an initial allocation of 1–2%), set pre-committed triggers for scaling or exiting, focus on learning as the primary return, and schedule review moments when uncertainty may collapse.

7. What role does confidence play in decision-making when uncertainty is high?

Confidence levels indicate how strongly you believe in specific outcomes. High directional confidence (like 98% predictions) paired with high structural uncertainty (production, regulation, infrastructure) suggests cautious engagement—small positions that preserve optionality while allowing you to learn.

8. How can I ensure my decisions remain reversible?

Consider small, incremental commitments that can be adjusted or withdrawn in response to emerging signals or changes in the landscape. Avoid locking into single vendors or architectures, and set clear exit triggers (like kill switches) that fire automatically when certain conditions are met.

9. What should I do during a convergence window?

Actively engage in learning and adjusting your strategies, as convergence windows present opportunities to validate hypotheses and refine decisions. This is when uncertainty may collapse, making it critical to have positioned yourself inside the game rather than waiting on the sidelines.

10. Can the framework be applied to sectors outside of AI?

Yes, the framework can be adapted to various fields where uncertainty and complex decision-making are prevalent. The core principles—using uncertainty to rule out wrong moves, sizing positions appropriately, creating pre-committed triggers, and treating learning as a return—apply to any domain where you must decide under conditions of incomplete information.